ONLINE PAYMENT SOFTWARE

Make getting paid

Get paid faster, easier, and more securely all in one effortless client experience.

Where payment simplicity

Checks? How retro. Venmo? So group dinner. Cash? Ew. HoneyBook? Professional and secure.

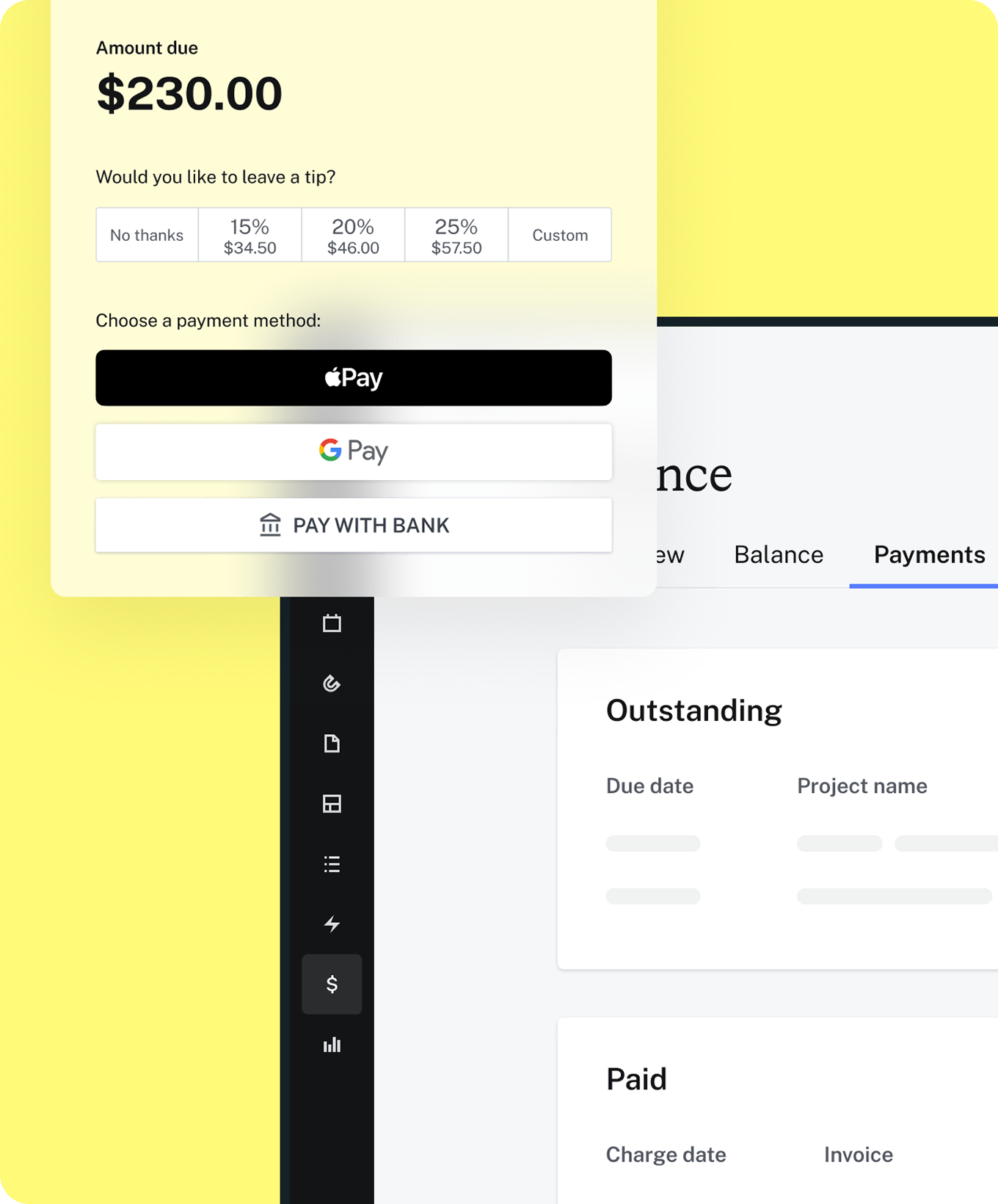

Accept every kind of payment

Let clients pay by credit/debit card, bank transfer, Apple Pay, Google Pay, and more.

Deliver a great experience

Let clients pay from any device without needing a 3rd-party app or ATM side quest.

Stay organized

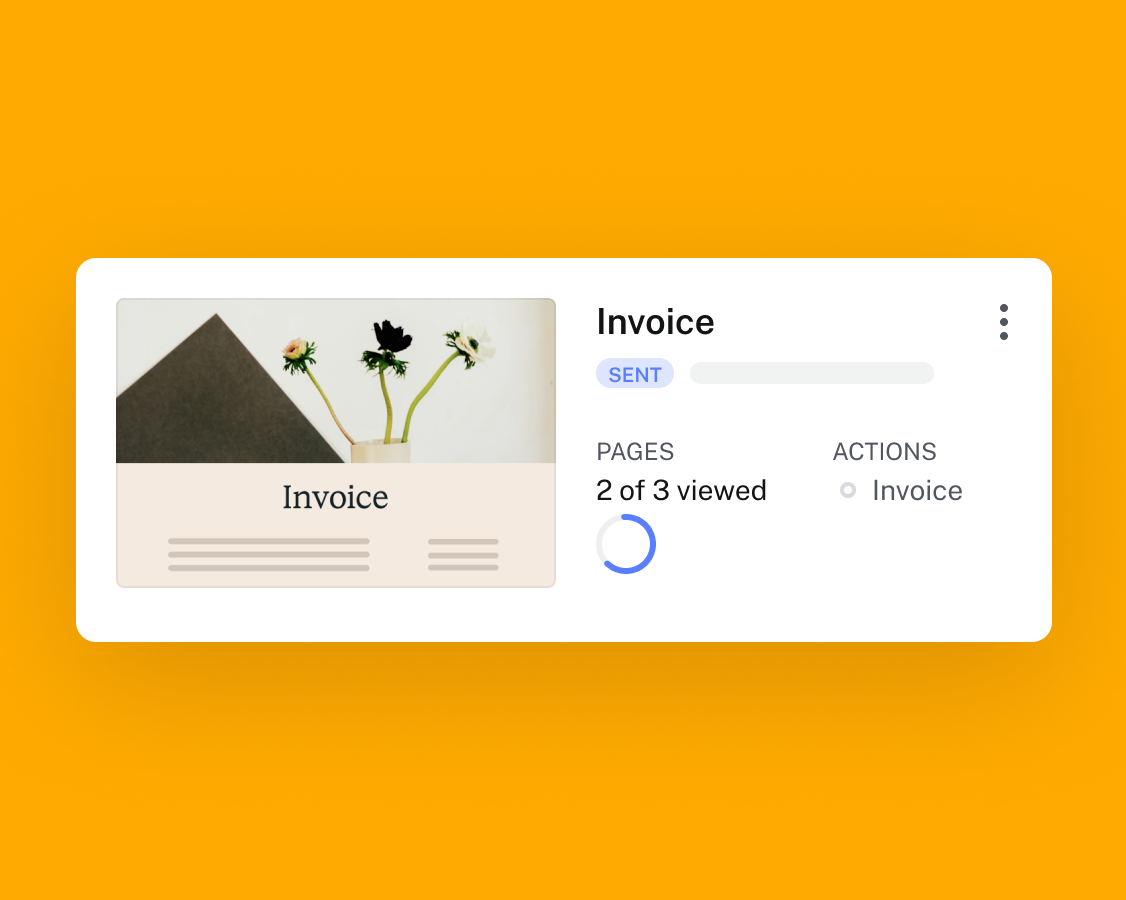

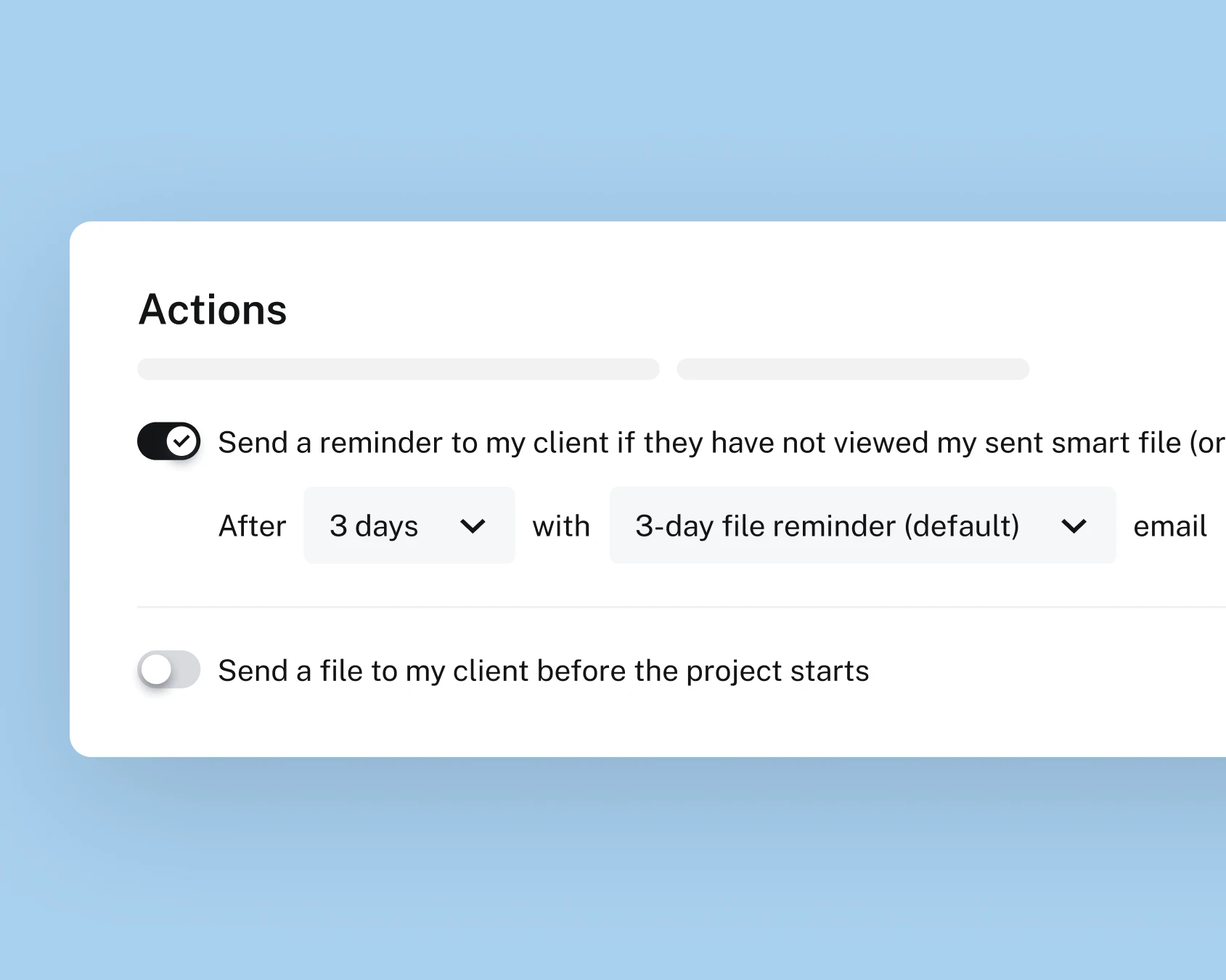

Manage clients and payments in one place with automatic tracking and reminders.

Rest easy

Our fraud and security teams are dedicated to keeping every HoneyBook transaction safe.

Built for faster payments

Keep more of your money.

Competitive and transparent fees start at 2.9% +25¢ for card or 1.5% for bank transfer (ACH) payments.

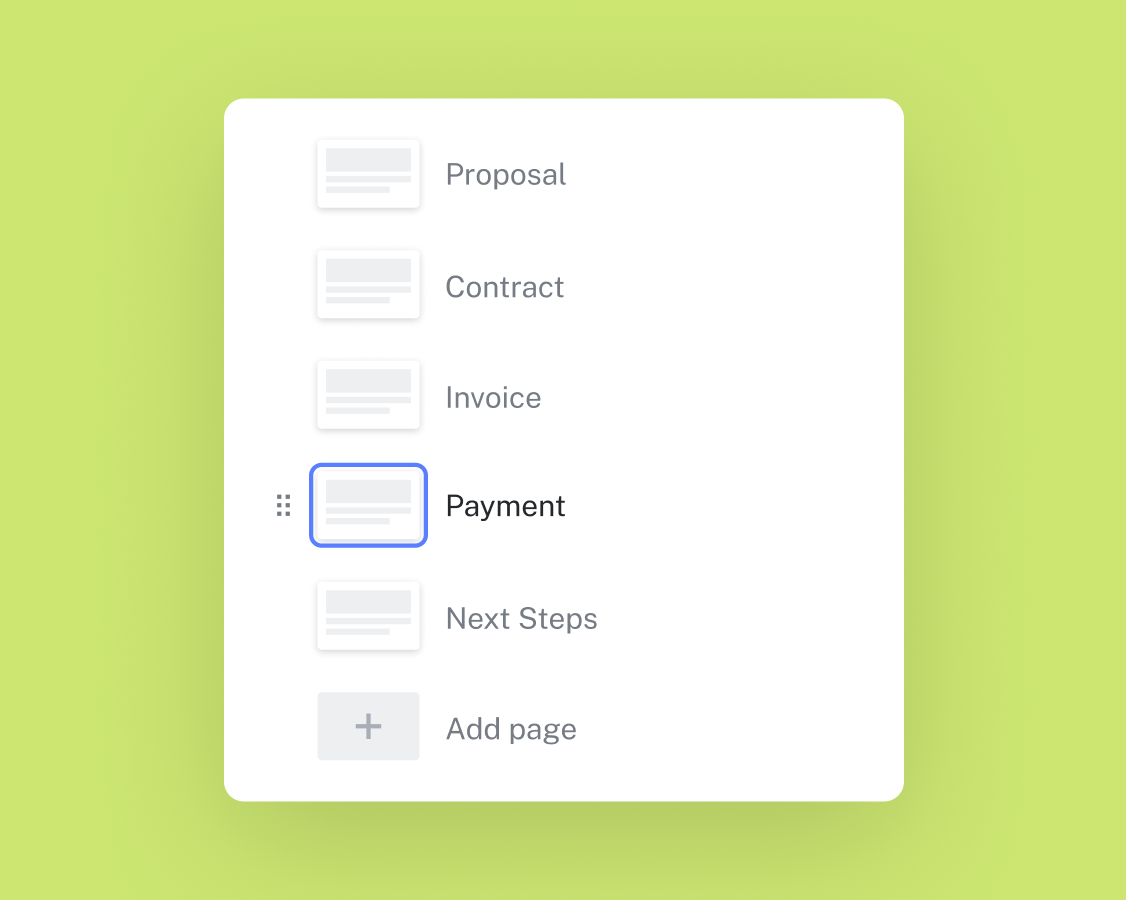

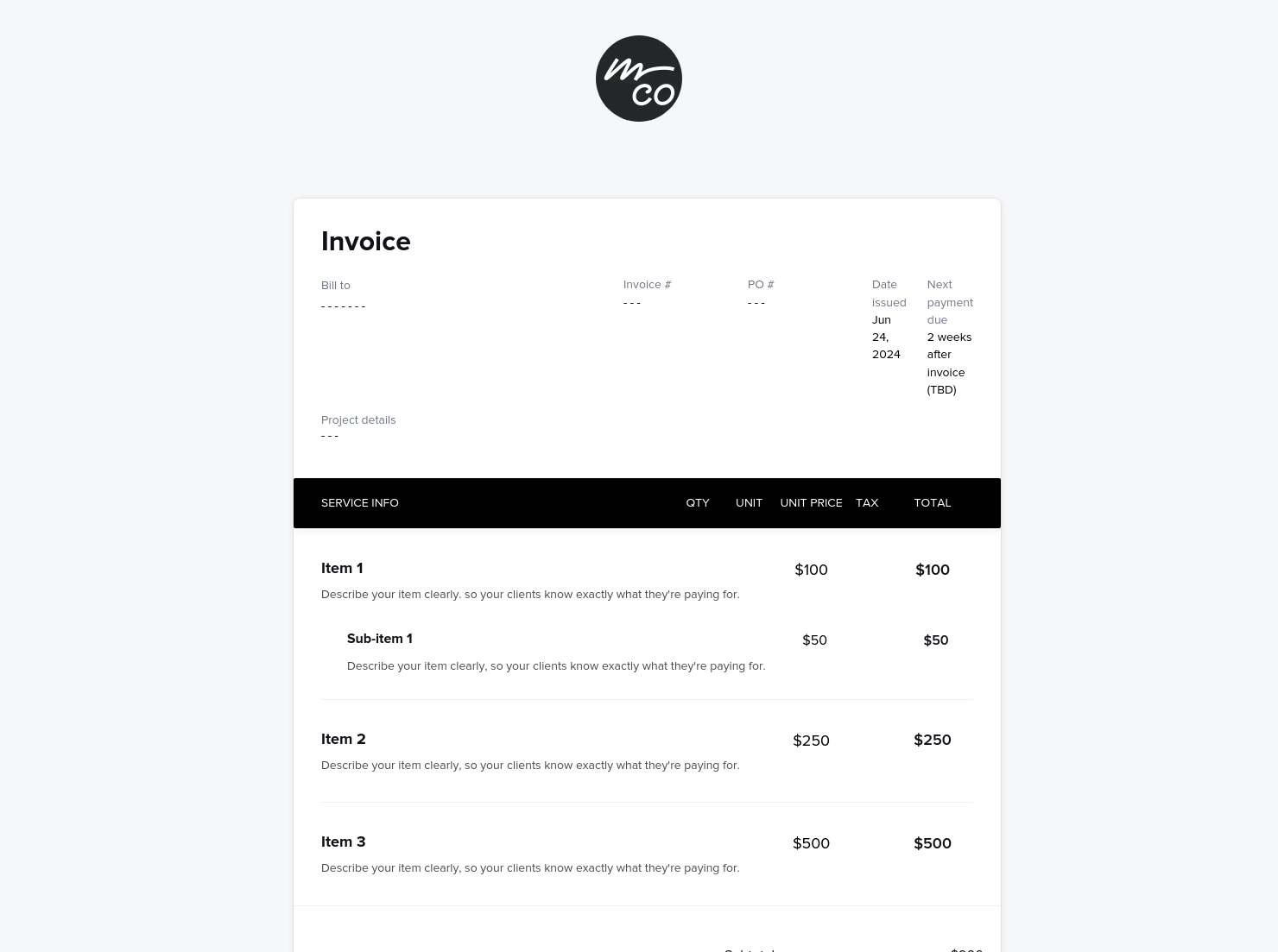

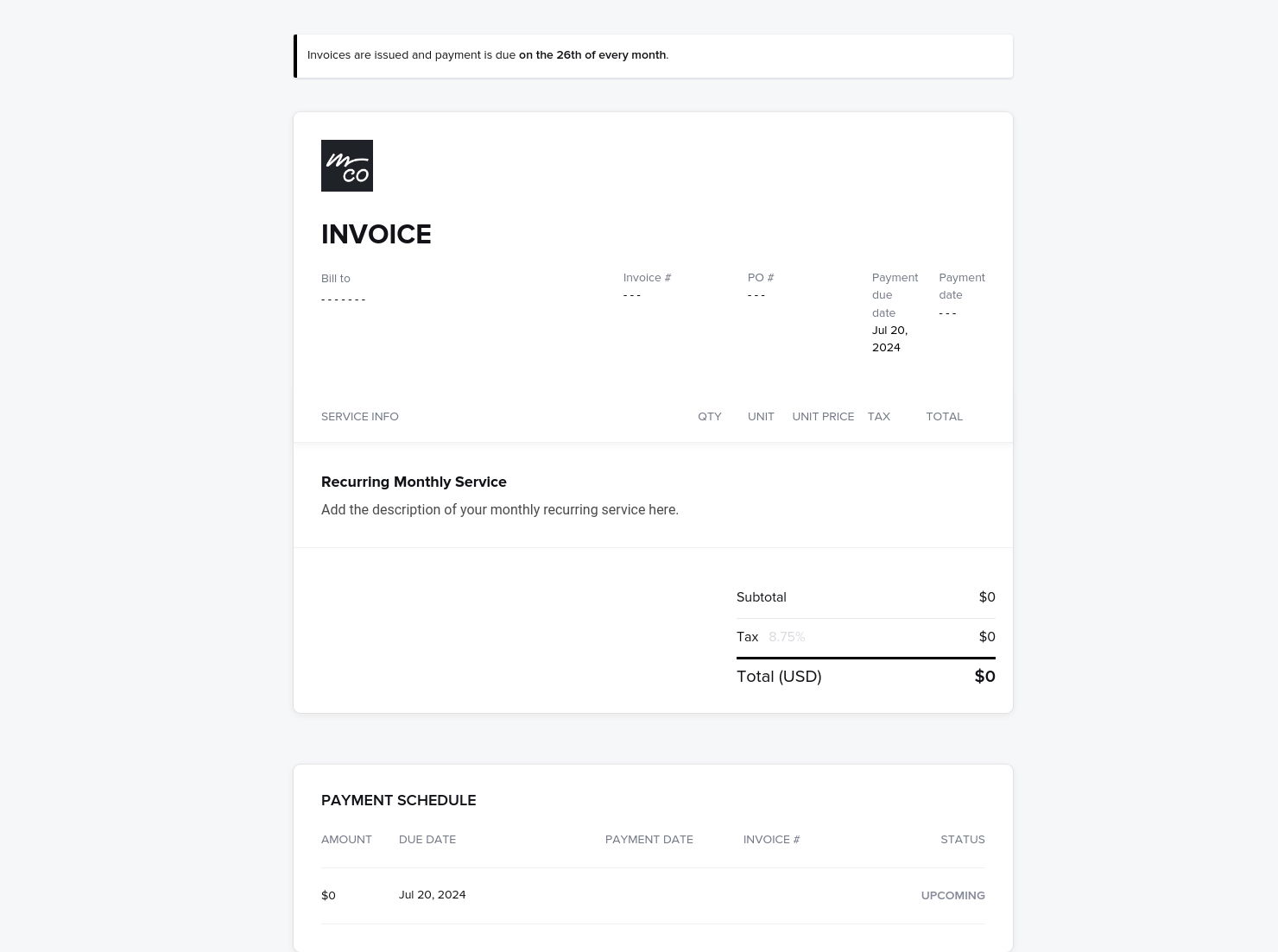

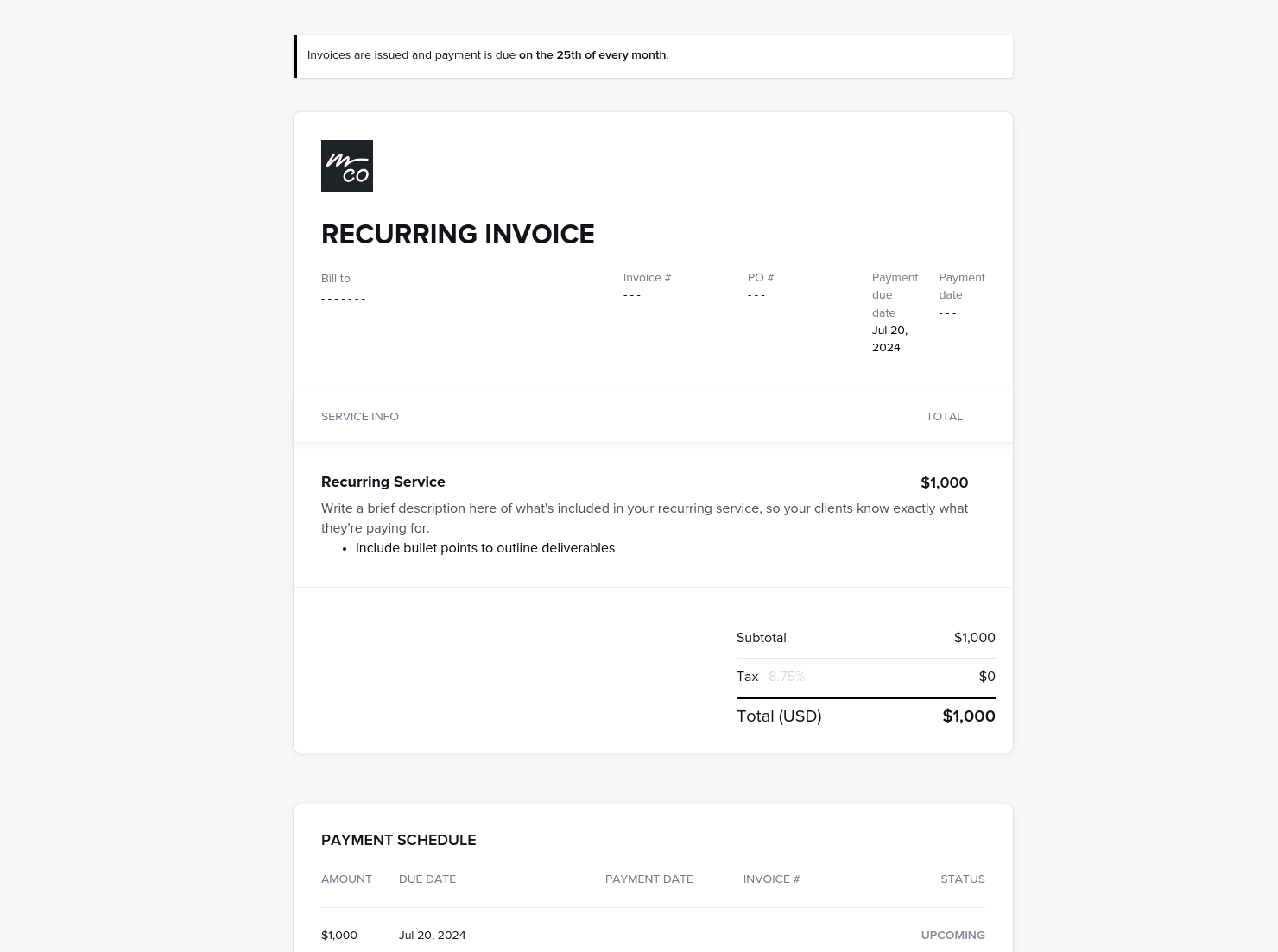

Start from a payment template.

Start with a professionally-designed template. Then add your fonts, colors, and logo so you can get paid in style.

Don’t stop there.

HoneyBook does a lot, because so do you. Keep exploring how HoneyBook can help your business thrive.

Payment FAQs

HoneyBook offers competitive rates: 2.9% + 25¢ for card payments or 1.5% for ACH. One fee applies per transaction with no hidden charges or deposit fees.

Yes, HoneyBook deposits funds directly into your account and lets you track paid, upcoming, and outstanding payments—along with estimated deposit dates.

HoneyBook processes all credit card and ACH bank transfer payments to keep your business info in one place. If you do use use other payment methods such as check, PayPal, or Venmo, you can manually mark outside payments as paid.

HoneyBook doesn't currently offer a built-in way to pass processing fees to client. However, if you want to do that—and your jurisdiction allows for it—you can add processing fees as a new tax. Simply rename it to "Service fee," add your percentage or flat fee, and apply it to services in your invoice.

Client disputes can be a headache, but here’s the good news—we work with you to understand the situation instead of automatically refunding your client. Our disputes team will contact you to get relevant details from you in order to resolve the situation in the best way possible.

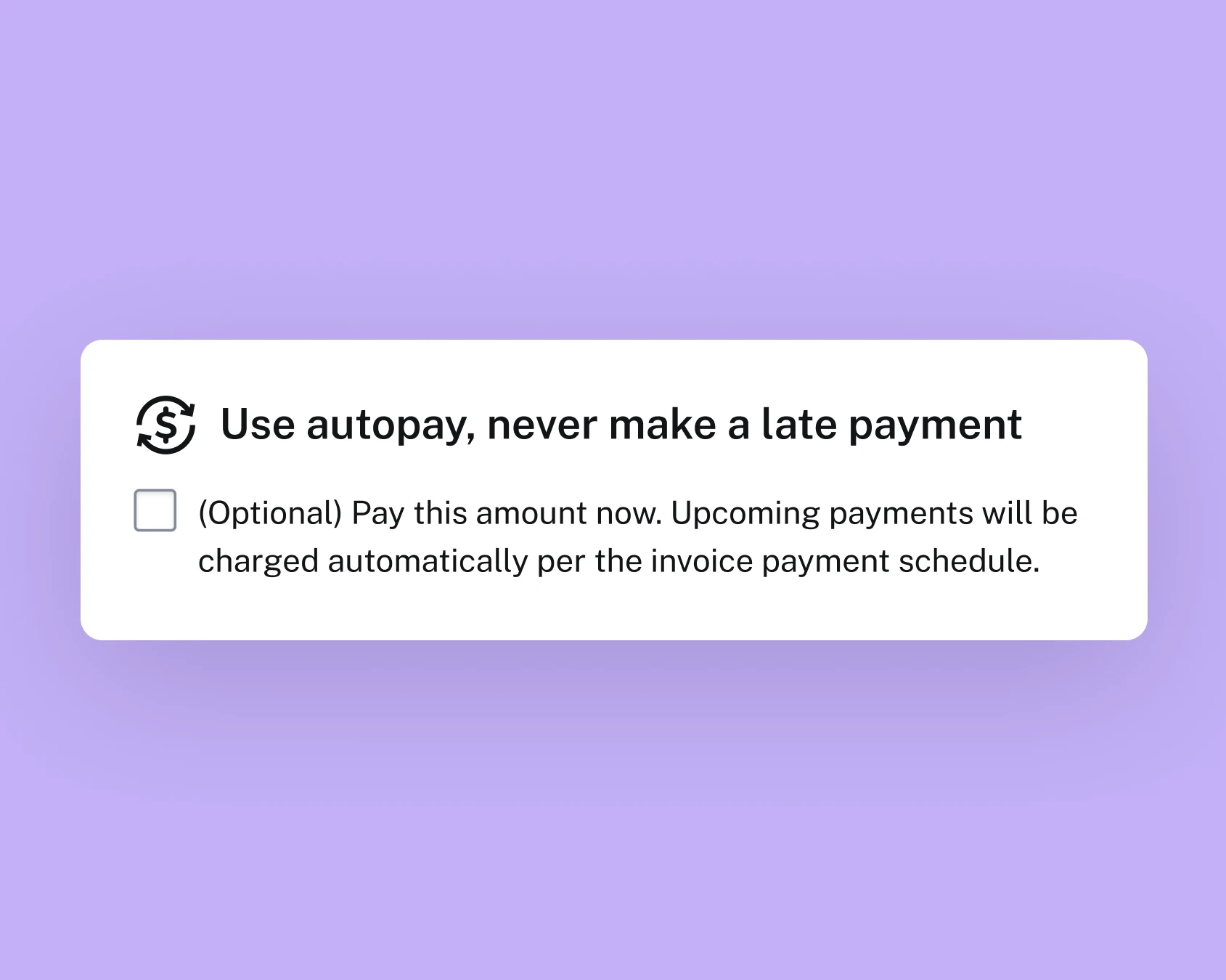

Clients receive an email with a secure link to their invoice, accessible on any device—no login or password needed.

They’ll see it exactly as you’ve designed it, complete with your logo, business name, payment details, and the option to enroll in autopay (if enabled). Once their payment is submitted, the funds hit your account instantly.

Yes, HoneyBook’s in-house fraud team monitors every payment to prevent unauthorized activity, so you and your clients stay protected.

Yes. Connecting QuickBooks Online syncs your HoneyBook payments automatically. When a client pays, HoneyBook creates an invoice and payment record in QuickBooks. Deposits appear in your banking section, and transaction fees are tracked in the QuickBooks expenses tab—no manual entry needed.

Instant deposit lets you access funds in minutes—24/7, even on weekends. Eligible card payments up to $5,000 transfer instantly for a 1% fee ($5 minimum).

HoneyBook helps you get paid on time with automated reminders, flexible payment options, and clear terms in your invoices and contracts—making it easier for clients to pay quickly and reliably.

Invoice reminder software automates follow-ups, reduces late payments, and helps you stay focused on running your business—not chasing invoices.