Make sure this tax season and stress-free and give you the best return possible this year. These 20 creative tax deductions can lower your tax bill, but you might not realize they’re write-offs for your business!

When the time comes each year to do your taxes, managing all the tax deductions and write-offs that apply to your business can be overwhelming. The good news is that there are many deductions available to independent business owners.

Deductions can help you increase your tax savings each year by lowering your tax liability. To help make tax time easier for you this year, we’ve put together a list of creative tax deductions for small businesses that you might be missing.

Jump to:

- How do I report my tax deductions?

- Should I itemize deductions?

- Online-related tax deductions

- Tax deductions for bills and utilities

- Fees and payments

- Tax deductions for goods and services

- Transportation tax deductions

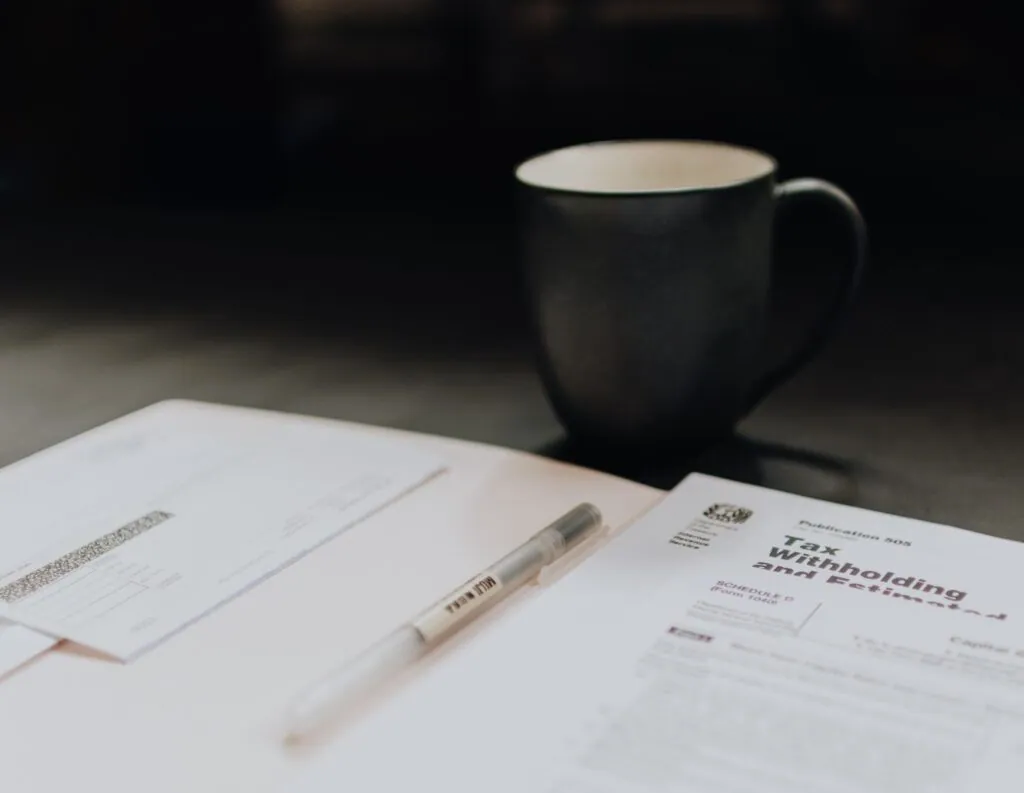

How do I report my tax deductions?

Whether you’re self-employed and a sole proprietor or a single-member LLC, you’ll use the tax form 1040 and Schedule C attachment to file your taxes and report deductions. Don’t worry about tracking down the form – if you use any type of tax-filing service like TurboTax or H&R Block (which we recommend), they’ll automatically fill out the form for you as you enter all your tax information.

If you’re not sure where to start first, use our tax filing checklist to gather all the documents and numbers you’ll need to file your taxes.

Should I itemize deductions?

When you claim deductions as a sole proprietor, you can choose to take standard deductions or itemized deductions. Standard deductions apply to your adjustable gross income (AGI) while itemized deductions require reporting every deduction. Both lower your taxable income.

Though it’s more work, itemized deductions can help lower your tax bill if you’ve spent more than the standard deduction for your tax bracket. To decide, look at the standard deduction rate for the tax year, compare your final itemized deduction value with the standard deduction, and determine which would make more sense for you and your business.

Online-related tax deductions

Here are common tax deductions you may come across related to online or digital expenses. It’s important to distinguish that if any of these digital services you use are for personal reasons only they can’t be claimed on your tax return.

1. Advertising, marketing, and websites

For small business owners, it’s a give-in that you’ll spend money on your website and advertising your business.

Luckily for you, there are a number of expenses you can claim when marketing yourself. Some of these include:

- Social media ads

- Traditional print ads

- Sponsorships

- Domain costs

- Monthly or yearly subscriptions to sites like Squarespace, WordPress, or Shopify

Tools like these help you build your business and the expenses can be written off, so don’t forgo them if you’re afraid of spending money!

2. Digital downloads

Another expense you’ll come across as a creative is digital downloads. If you download and purchase content for creating graphics or populating your website, you can lump these together under project costs.

Examples of these include:

- Fonts

- Stock photos

- B-roll

- Other digital images for business use

3. Software

Whether it’s software suites or online subscriptions, this category can include any software for which you pay a monthly or annual fee.

Some examples could be:

- Cloud storage like Google Drive, Dropbox, or OneDrive

- Other Google apps for your business

- Adobe Creative Suite

- Microsoft Office

- Digital or premium subscriptions like Canva or LinkedIn

- Business management software like HoneyBook

These are all examples of items that are tax deductible. Save your receipts!

Tax deductions for bills and utilities

From connecting with clients to just keeping the lights on, there are several bills and utilities you can claim as a creative for your small business.

4. Cell phone

If you use your cell phone to do your work, this can be claimed too.

Most small business owners have one cell phone they use for both business and personal purposes. The cost of your phone and the monthly charges can be split up based on an estimate of how much you use your phone for business purposes.

5. Home office utilities

Have a dedicated space in your home for conducting business? This is something you can claim to reduce the ultimate cost of your electricity and heating/cooling.

These costs will depend on the size of your office or workspace. You’ll need to calculate the square footage of your space, then claim that percentage of the total square footage of your home. For example, if your office space takes up 10% of your home, then 10% of your total utility costs for the year are tax-deductible.

6. Internet

Just like with home office utilities, you can claim the internet service you use for your small business, which may be deductible as either a utility or office expense.

However, just like if you have a cell phone only partially for work, if you also use your internet service for personal use, you should only deduct the estimated portion used for business.

Fees and payments

There are lots of costs small and large that can add up for Independent businesses related to regular payments that aren’t related to utilities. Here are some examples you may be able to claim.

7. Commissions and fees

If you have affiliate payments, this is where you can claim them on your taxes.

Some examples of these may include:

- Commissions

- Merchant processing fees

- Service fees

8. Insurance

If you’re self-employed and pay for your or your family’s health insurance, you may be able to deduct your premiums to ease the burden of these payments. These can be claimed as a deduction against your personal income.

On top of that, if you pay liability insurance or any other insurance to protect your business, this can also be deducted.

9. Loan interest

If you’re trying to get your small business running and have a bank loan or accrued credit card interest, this might qualify as a business expense tax deduction.

Once again, only the business portion of your loan’s interest can be deducted if a loan is for both personal and business purposes. So, unfortunately, your personal credit card debt can’t be claimed. You also won’t be able to deduct student loans, since you can only deduct interest on student loans for your personal taxes.

10. Retirement contributions

Independent business owners often don’t have the luxury of a company retirement plan like a 401k. However, preparing for retirement should be on your mind if you have a 401k or not!

Luckily, there are still plenty of options to financially plan for your future. You may be able to set up a SEP IRA, SIMPLE IRA, or solo 401k as a self-employed worker or small business owner to save for retirement. Any contributions you make to a SEP IRA can be deducted from your tax return for a nice return at tax time!

However, it’s important to be mindful of your annual contribution limit, which can vary by plan.

11. Other expenses

In this category, if you have any business-related expenses that can’t be placed in any other category or mentioned in this article, you can make up your own sub-categories of expenses.

These might be miscellaneous expenses including employee and client gifts, employee benefits, etc.

Tax deductions for goods and services

As a business owner, you could buy many different things for your business, whether it’s an asset like a laptop, or something as small as pens and paper. On top of that, you may need the services of other professionals like you to keep your business afloat.

Here are some examples of tax deductions that may apply to you based on various goods and services you may require over the course of the year.

12. Clothing

While it seems logical that you should be able to deduct an outfit you only wear for shooting weddings or speaking at events, unfortunately, most clothing won’t qualify as a business expense.

However, if your clothing purchase is deemed ordinary and necessary via publication 535, then it may be deducted. Typically, this is for clothing like protective gear, uniforms, and costumes, so it typically wouldn’t apply to an independent business owner. Usually, you can consider it a personal purchase. Some of the requirements say the clothing:

- Must be specifically required by your employer

- Must not be suitable for taking the place of your regular clothing

13. Contract labor

If you pay any other creatives like yourself or contractors to conduct your business, the total amount paid to them goes under the Contract Labor category.

Some of these could be:

- Second shooters

- Virtual assistants

- Subcontractors

14. Education and conference expenses

Have you incurred expenses to educate yourself and improve your business? These can be deducted as a business expense.

This includes:

- Books, whether e-books or physical books

- Online courses

- In-person conferences

- Coaches

- Any other educational expenses

Note that education received from an accredited university will count towards a tax credit rather than a deduction. Talk to a licensed tax professional about whether to take the credit or deduct the educational expense.

15. Home office equipment and supplies

Any home office equipment or supplies you purchase for business purposes should be claimed on your taxes.

You’ll usually want to classify any equipment that will be used for a year or more as assets on your tax return. These are substantial expenses that will usually last you quite a few years. A few examples of assets are:

- Computers

- Cameras or lenses

- Printers

For these items, you can report the asset’s depreciation as a deductible expense.

You may also be able to deduct the cost of smaller office supplies bought for business use, like paper, pens, printer cartridges, and so on.

16. Legal accounting and services

If making sense of legalese or tax deductions beyond the basics is too much for you and you hire a lawyer or accountant for business, any fees that you may have paid in the last year can go into this category.

This includes fees for tax advice or the preparation of the business portion of your taxes.

17. Meals and entertainment

Within reason, food or drink expenses incurred while having a business meeting are deductible business expenses. You should record the expenses at their full cost in your bookkeeping, and on your tax return, report them at 50% of the total cost. (In 2022, these expenses are 100% deductible!)

However, if you’re just going to a coffee shop to get out of the house and get work done, those expenses aren’t deductible.

18. Repairs and maintenance

Any expenses related to repairing or maintaining your equipment or office space would go into this category of your tax return.

For example, if you’re a photographer and you send your camera to the shop to get calibrated and cleaned, you can claim the maintenance cost under this category.

Transportation tax deductions

If it’s driving from client to client or traveling for business, these are all deductions you can claim on your tax return.

19. Car or truck expenses

If you use a vehicle for work, it’s important to be meticulous about the use of your vehicle, especially if you use it partly for personal use as well.

This category is where you’d report either your total mileage on the vehicle for business purposes for the year or the business percentage of all your auto expenses.

20. Travel

In addition to business miles traveled or auto expenses, you can also deduct business travel expenses.

These include things like:

- Taxi fare

- Airline or train tickets

- Hotel costs

- Luggage fees

Maximize your tax deductions—you deserve it!

Still feeling a little unsure about when/how to claim your expenses as tax deductions? Try not to get too hung up on what category to choose for each expense.

The IRS is most concerned with making sure that you’re reporting all of your income and you aren’t over-reporting your expenses. So as long as you stay within those bounds, your tax return shouldn’t be too tricky.

However, while these are the deductions most commonly asked about, there are many more deductions available to independent business owners. So, when trying to decide whether or not something is a business expense, think about whether it helped you to run your business or make your business better.

Lastly, don’t be afraid to ask for help from an expert when needed or invest in the right software to improve your tax process. With a clientflow platform like HoneyBook, you can track all your transaction and expense data in one place to make it easier to prepare for tax season.