Examine five of the best invoicing software for small business. Learn the advantages and disadvantages of each, as well as why HoneyBook stands out from its competitors.

Professional invoices are vital for sending out quotes, billing your customers, and tracking expenses. Today, there are a variety of invoicing software options. Each invoice app claims to be the best option on the market. As a result, it can be difficult to know which is the best invoicing software for small businesses to use.

Today, we’ll break down the five best pieces of invoicing software for small businesses. Learn the pros and cons of each, including the specific invoicing features included in each one. Once you know the advantages and disadvantages, you can begin to make an informed decision that’s best for your business.

Jump to:

- Evaluating the best invoicing software for small businesses

- PayPal

- Intuit QuickBooks

- FreshBooks

- Zoho Invoice

- HoneyBook

- Go beyond the best invoicing software for small businesses with HoneyBook

Evaluating the best invoicing software for small businesses

Basic invoicing software needs to do two things. First, it needs to be able to create an itemized, professional-looking invoice. And second, it needs to be able to send that invoice to your customers.

But for invoicing software to truly meet the needs of small business owners, it needs to include standout features that go above and beyond this minimum expectation. The best invoicing software should offer additional features, such as integrated payments, contract signing, and client communication. Access to these invoicing features allows small business owners to streamline their workflow and spend less time on administrative details, which is critical in a fast-paced digital landscape.

Let’s take a look at the five top billing software companies on the market and the pros and cons of each.

PayPal

When it comes to invoicing software, a lot of small businesses start off using PayPal’s built-in features. For businesses that are just dipping their toes into the concept of providing professional invoices to their clients, PayPal is a free option that’s relatively easy to use. And the majority of your clients will have heard of PayPal, so a lot of the trust-building process has already been done for you.

Invoice templates and invoice customization

PayPal allows you to create and save up to 50 different invoice templates free of charge. These templates can be customized based on how you charge your customers (per hour, per item, or flat fees), and you can add your business information and logo in. However, the invoice template options don’t go further than that.

PayPal invoice templates are free to use initially, but you are charged after a customer pays the invoice. PayPal charges a fee of 3.49% + $0.49 per domestic transaction.

Recurring invoices

You can set up a recurring bill in PayPal to send to customers on a regular basis. However, keep in mind that PayPal does not let you bill the same customer this way more than once a month. This means that if you have a more frequent contract with a customer, you will either need to send invoices manually or you will need to be okay with being paid a single monthly sum.

Payment processing

Once money comes in, it sits on your PayPal account until you manually transfer it somewhere else. You can transfer money to a bank or eligible card, or you can request money be mailed to your address.

Transferring money to your bank within 1-5 business days is free. However, if you want your money transferred more quickly, or if you want money transferred to a card, you are required to pay a fee. You also pay a fee if you request the money sent to you as a check, which generally takes 10 business days.

Payment reminders

PayPal does not send payment reminders automatically. However, if you go to the invoice management page, you can send reminders out to all unpaid invoices at any time.

Additional features

PayPal is primarily an invoicing software. One of the biggest reasons business owners eventually move to other options is because they provide a more robust suite of features.

Intuit QuickBooks

With over 28 years of helping small businesses manage their accounting needs, Intuit QuickBooks is often looked at as the next step up after PayPal. This paid option offers different levels of service depending on which invoicing features you’re looking for.

Invoice templates and invoice customization

QuickBooks Online allows users to choose from a number of pre-made invoice templates. These invoice templates are customizable. You can save these templates as PDFs and re-upload them if you want to use them again in the future.

Recurring invoices

QuickBooks allows you to set up recurring transactions fairly simply. QuickBooks allows you to schedule these transactions ahead of time and set them to recur as frequently as you like. You can also CC yourself on these transactions so you know they’re being delivered on time.

Payment processing

Customers can pay QuickBooks invoices in a variety of ways, including credit or debit cards and ACH bank transfers. Once a payment has come through, you can transfer the money to your bank. Most deposits occur on the next business day.

Payment reminders

You can set up payment reminders in your account and schedule how frequently you want them to be sent for unpaid invoices.

Additional features

QuickBooks offers a variety of optional features and services, including:

- Managing reports

- Managing and paying bills

- Tracking project profitability

- Managing employee expenses

- 24/7 support

Unfortunately, QuickBooks can quickly become expensive if your company needs to use its more robust features.

FreshBooks

FreshBooks is one of the top competitors of QuickBooks. It offers a free trial and integrates with PayPal to accept online payments directly. All plans also include Client Portals, which allow clients to interact with your company more directly than with tools like PayPal.

Invoice templates and invoice customization

FreshBooks offers a variety of templates that you can customize with your business information. However, keep in mind that FreshBooks keeps its branding on invoice templates as well.

Recurring invoices

You can set up recurring payments through FreshBooks when you choose to use a recurring template. Keep in mind that you have to do this when you first choose the template for a payment as you cannot make the invoice and then choose to make it recurring.

Payment processing

Once customers pay their invoices, FreshBooks works on moving the money to your bank account. This process takes approximately two days. However, they do charge a fee for processing your payments.

Payment reminders

You can set up automatic payment reminders in FreshBooks and even charge late fees on outstanding balances.

Additional features

One of FreshBooks’ standout features is its Client Portals, which allow clients to interact with your company more directly than with tools like PayPal. However, more advanced features, like accepting payments over the phone or offering subscription-based payments, come with a significant upcharge.

Zoho Invoice

Zoho Invoice is one of the most budget-friendly options on the market. However, it also has some major limitations, such as its limit that businesses only interact with a maximum of five customers at a time.

Invoice templates and invoice customization

Zoho Invoice offers fully customizable templates, and the free plan allows you to create up to 1,000 customized invoices per year. Users can also easily convert estimates into invoices.

Recurring invoices

Zoho Invoice makes it easy to set up recurring invoices. You are allowed to choose how often these invoices are sent to customers.

Payment processing

Zoho Invoice allows you to accept payments in a variety of online methods, including via debit cards and credit cards. You can integrate Zoho Invoice with a variety of payment gateways; these payment gateways are ultimately responsible for processing payments and getting the money to your bank.

Payment reminders

You can set up automatic reminders in Zoho Invoice for up to a maximum of 30 invoices at a time.

Additional features

Zoho Invoice allows you to interact with clients through client portals. However, it limits businesses to a maximum of five customers at a time. There is also no inventory tracking through Zoho Invoice, which makes it much less effective for e-commerce businesses than for independent contractors.

HoneyBook

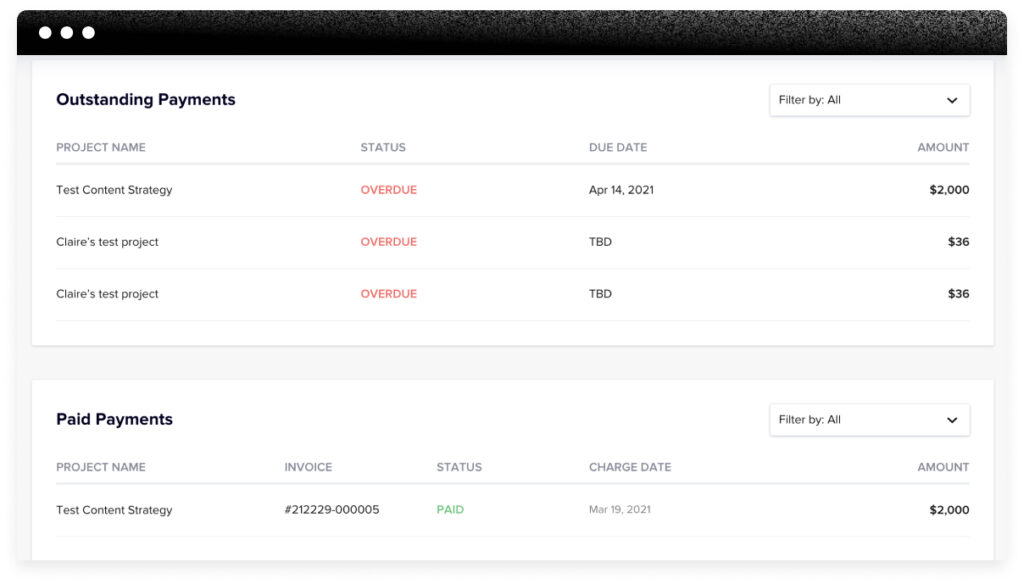

HoneyBook is a one-stop solution for client interactions, unlimited invoices, contract signing, and more. Invoicing and payment are combined into one simple experience for customers, and 90% of invoices are paid on time or early with HoneyBook.

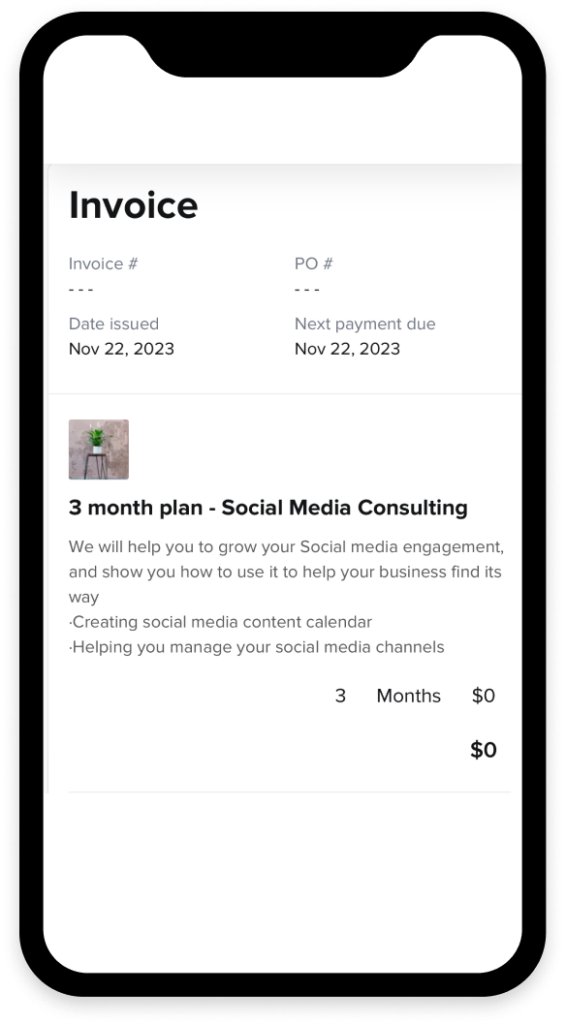

Invoice templates and invoice customization

HoneyBook allows you to choose from a variety of beautiful and customizable invoice templates. Each of these templates can be easily updated with your branding, logo, and color preferences to guarantee a branded experience for your customers. Furthermore, it’s easy to use the HoneyBook builder to drop in your specific payment terms and prices.

Recurring invoices

HoneyBook allows you to set recurring payments as frequently as you wish so that you don’t have to remember to send invoices to the same customers week after week or month after month.

Payment processing

HoneyBook allows you to accept both card payments and ACH transfers, making it easy to offer multiple payment options to your clients. But unlike most competing brands, HoneyBook users can access their funds instantly. This means that you never have to worry about transfer times or delays. Once your customers have paid their invoice, you have access to the money in 2-8 business days, depending on the payment method.

Payment reminders

HoneyBook lets you turn on upcoming and late payment reminders so you can avoid late payments. Instead of chasing down outstanding invoices, HoneyBook will take care of it for you. Plus, you can edit the copy in your payment reminder emails to ensure that they fit your brand and tone.

Additional features

HoneyBook stands out because it offers features at the basic level that other brands consider premium. Client portals, unlimited invoicing, proposals, templates, reports, and calendar access are all available at the basic subscription level. This makes HoneyBook an ideal invoicing software that any level of business owner can use to improve success and efficiency.

Take advantage of expense tracking inside HoneyBook along with QuickBooks integration so you can have everything you need for accounting. Get detailed reports about where your money is coming from. HoneyBook also includes time-tracking tools you can use on desktop and in the mobile app so you can pair your invoicing with more accurate hourly billing.

Furthermore, you can also enjoy some project management tools like team member access and task management.

Go beyond the best invoicing software for small businesses with HoneyBook

Basic, free invoicing software can be useful. But for small business owners who are ready to graduate to the next level of invoicing and client management, there is no better invoicing software than HoneyBook.

Access a wealth of user-friendly features that simplify your workflow, help you manage your cash flow, and offer pricing plans that make sense for different stages of business growth.