SEO is all the rage lately—and rightly so! Traffic is down everywhere, and competition is up. But together we can organically increase our traffic through search engine optimization.

And the thing that is the foundation of all other SEO work? Keywords! They have the power to make or break your entire strategy.

If you select keywords that few people search for, ranking at #1 won’t have an effect on traffic or sales. But if you select keywords that everyone is looking for and try to compete with big corporations, you could have the best content yet no one will find it. Selecting keywords is arguably the most important SEO work you will do.

What do we mean by “keywords”?

Keywords, in the SEO world, are the terms for which we want to show up in search engines. These could be one-word keywords, two-word keywords, or complete phrases, but to simplify things, we’re going to stick to one term: Keywords. (Long-tail keywords” are often espoused in SEO talk. Long-tail keywords are simply phrases. Y’all, seriously—why can’t you just call them phrases?)

Step 1: Discovering your current keywords

First, we want to find out what keywords you are already ranking highly for. If you’re a new blogger/webmaster, it is not uncommon to have very few of these. Don’t be discouraged, because we’re going to change that.

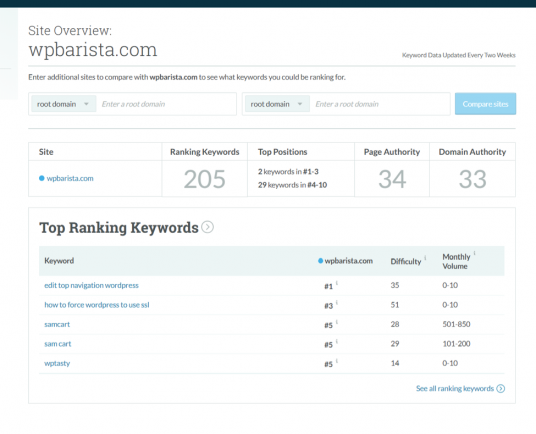

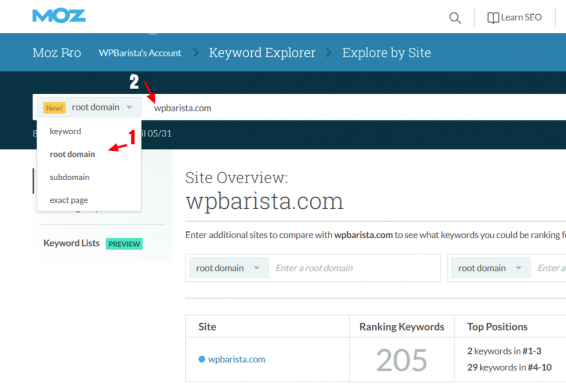

1. Go to https://moz.com/explorer. (You can only use 10 queries per month for free.)

2. Select “Root Domain” from the drop down.

3. Enter your domain name, exactly as it is in Google Search Console or Analytics—if you use the “www” on your site, include it here.

4. Make a note of all the words you see in the “Top Ranking Keywords” section. Also make a note of the monthly volume for each one.

- If you look closely, you’ll notice that I show up #1 for the keyword, “Edit top navigation WordPress”. However, look at the monthly volume—a whopping 0-10 people actually search that term. Not Helpful! (It’s not literally 0-10—the important thing is to look at all the numbers in relation to each other to compare their search volumes. Basically, this term’s volume is 500x less than “samcart”.)

- Another optional tool: https://neilpatel.com/seo-analyzer/

Now that you’ve seen whether you’re ranking near the top for relevant keywords, let’s find out which keywords are actually sending the most traffic to your blog.

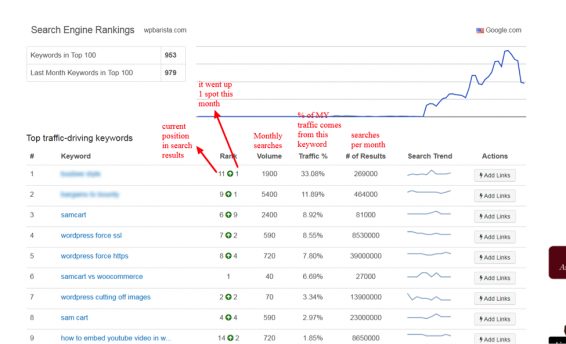

1. Go to https://www.thehoth.com/search-engine-rankings and enter your domain name.

2. Patiently wait for the page to finish thinking—it takes time!

3. You’ll see results like this:

4. This list shows up to 50 keywords that send the most traffic to your site.

- If they aren’t what you had been hoping for, don’t fret—we’re gonna make a plan to change them.

5. Make a note of the top keywords (that you like) and the “volume” and “results” columns. These will come in handy later.

- Even if those keywords are perfect, don’t skip the research part—it will still apply to all new content that you write.

At this point, you know the keywords that you are already ranking for. You know roughly how many visitors they send to your blog. And you should be getting an idea of whether or not you need to switch things up!

Now we can move on to the fun part: let’s find the keywords that are going to drive traffic and bring raving fans and customers to your website.

Step 2: Selecting the most effective keywords

It’s time to find the best variations of the keywords you’re considering. I love this part because if you do it right, you’ll see immediate results.

1. Go to https://kwfinder.com/.

2. Enter the most common keywords in your niche. Start broad and then narrow in as you work through this. Select the country where most of your audience is and select your target language.

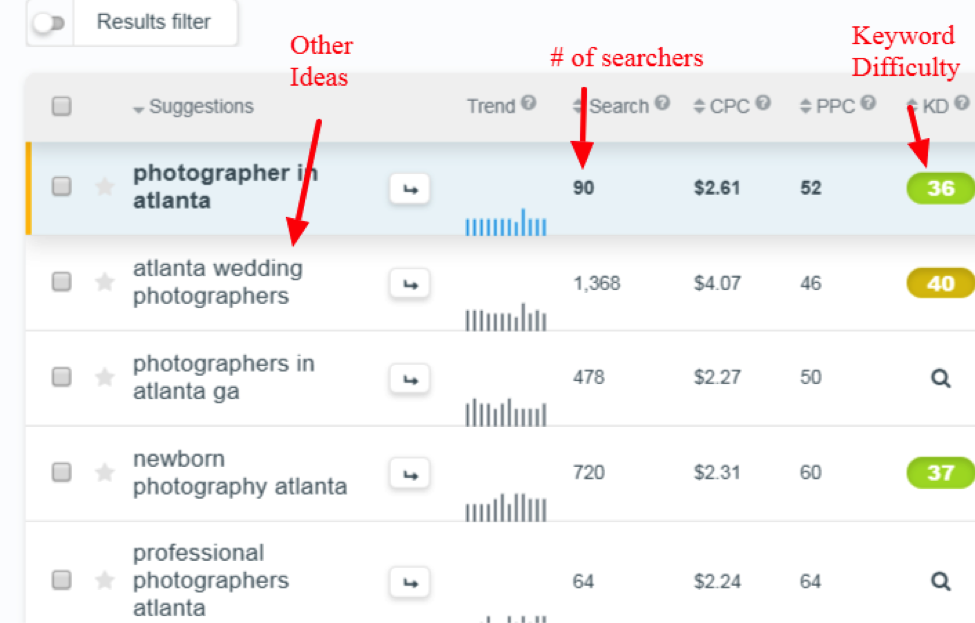

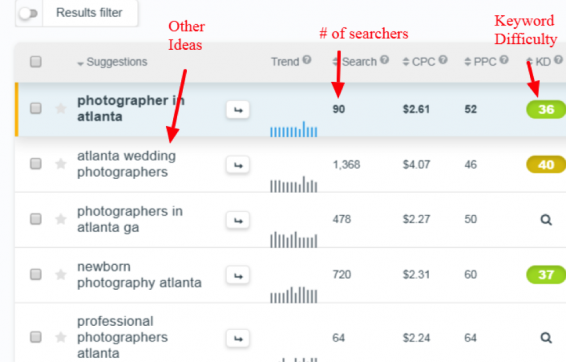

- In this example, I’m an event photographer working in and around Atlanta. So I entered “photographer in Atlanta”.

3. Evaluate the results. Look for keywords that have KD (Keyword Difficulty) scores with a “green” result and show a good number of visitors.

Now you have a good idea of which keywords you should use for optimizing, and which ones aren’t worth aiming for.

- If you had a young blog and were starting out, I would go with “Photographer in Atlanta”.

- If you were seasoned and had incoming links to your site, and your domain is a few years old (with active updating), I would go for a keyword with higher volume of searches.

- You can perform five searches for free each day with this tool.

Other Tools for finding your keywords.

- https://neilpatel.com/ubersuggest/

- https://moz.com/explorer

- https://www.wordstream.com/keywords (provides accurate search volume but no competition info)

There’s a lot that goes into optimization of your pages, domain, and social media networks—it’s never boring in the SEO world! I hope this guide helps you find those massively effective keywords that will help you stand out on Google.