Learn how to write an effective payment reminder email, ensuring timely payments, positive cash flow, and healthy client relations.

The payment process can be tricky for small business owners. Especially when it comes to unpaid invoices, you have to maintain a balance of being polite enough to keep a great relationship with your client, but stern enough that your client feels a sense of urgency to pay you.

Whether your client is a week late or a month late on payments, we’re here to help you walk that tightrope.

In this article, we’ll start with tips for politely asking a client for payment, and then we’ll provide email templates for every stage of the payment reminder process that will help you get paid faster.

Let’s start with some tips!

Jump to:

- What should I include in my payment reminder email?

- 10 best practices to writing a payment reminder email

- 3 examples of payment reminder emails

- How to send a payment reminder email

- When should you send payment reminder emails?

- How to avoid late payments in the first place

- Customer retention strategies

- What to do if you don’t receive payment

- Get paid faster with the right tools

What should I include in my payment reminder email?

Get straight to the point. Include these crucial items that you should include in your reminder message:

- The initial payment due date

- How long the payment has been overdue

- The outstanding balance

- Payment options

- Attachments or links to invoices that are relevant

- Instructions on how to make payment

- Your late payment terms and policies, including applicable late fees or consequences

These are the minimum requirements for what to provide in your follow-up emails. To make sure you’re communicating clearly, let’s walk through 10 tips for crafting your reminder messages.

10 best practices to writing payment reminder emails

1. Use a clear subject line

Make your client’s life easier by giving them all the information they need directly from your email’s subject line.

When writing your email subject line:

- Use clear keywords like “Payment reminder” or “Overdue invoice”

- Include the invoice number

- Include the payment date

Here’s what that looks like in action:

Subject: Payment Reminder: Invoice 1/3 – Due October 1

2. Refer to the invoice

Don’t make your client dig through their email history to find the outstanding invoice. Re-attach the invoice to your email, or provide a link if you’re using an online invoice. If you’re prone to forgetting to add attachments, attach the invoice before you type a single word, or use a system like HoneyBook that attaches the invoice file to each payment reminder email automatically.

3. Start with a polite introduction

You don’t want to come off as too cold. Start your email with a polite and personal introduction. This ensures that you’re using a friendly tone, which may be more likely to get a response. That can be as simple as greeting the client by name and then including a single line wishing them well.

Just be sure to strike a balance with a professional tone as well. I recommend avoiding exclamation points or emojis so your client knows you still mean business.

RELATED POST

4. Personalization can help

Personalizing the payment reminder can help maintain a positive relationship with customers. Techniques for personalization can be based on customer history, preferences, or past interactions. The key is balancing professionalism with personalized touches to encourage action.

5. Tone and language

Write in a professional and courteous tone while conveying the urgency of the situation. Avoid accusatory language. Focus on problem-solving and assistance. Consider expressing appreciation for past business while requesting timely payment. This communicates that you value your relationship with the client.

6. Make the payment terms clear

Yes, this sounds obvious. But it is the most important part of your email is to remind the client how much is due, and when the payment is (or was) due.

Don’t be vague: include the exact due date of the invoice and avoid making confusing statements like “due on receipt.” If you have to send multiple reminders, continue to update the timeline, whether it’s a day overdue, a week, or more. Doing so will help you document the late payment in case you need to refer back to your reminders.

7. Include details on how to pay

While you may include payment details on the invoice itself, you should also include a clear call to action in your email to complete the payment. You can either include a link to your payment portal or provide detailed instructions for making a payment. For example, if you accept checks, you’ll want to make sure your clients know who to address the check to and where to send it.

Pro tip

By using an online payment software like HoneyBook, you can give your clients a convenient link that includes your invoice and payment processing in one interactive file.

8. Confirm receipt

If this isn’t your first reminder, you may want to use this opportunity to check with your client that they have actually received your invoice. Not only does it give you peace of mind, but it’s also a convenient way to shift the conversation to something other than “please pay me.”

For example:

Please confirm receipt of this invoice so we can make sure we have your correct contact information.

If you’ve already received a reply to a previous email from the client, you could modify this section to ask your client when you should expect to receive payment.

9. Include consequences of late payment

If the payment is already late, you may have to remind your client about your late payment policy. But unless the payment is really late, try not to sound too threatening.

For example:

As a gentle reminder of our payment terms, a late fee of 5% will be applied for every week the overdue payment is not paid.

Other policies might include canceling the contract. You might not need to repeat your full late-payment policy, but be sure to remind your clients about any milestones that are coming up, such as canceling services at a certain date or applying another late fee.

Just keep in mind that you need to establish late payment terms at the start of your working relationship—ideally in an online contract. Otherwise, you can’t pursue any legal action in regard to these policies.

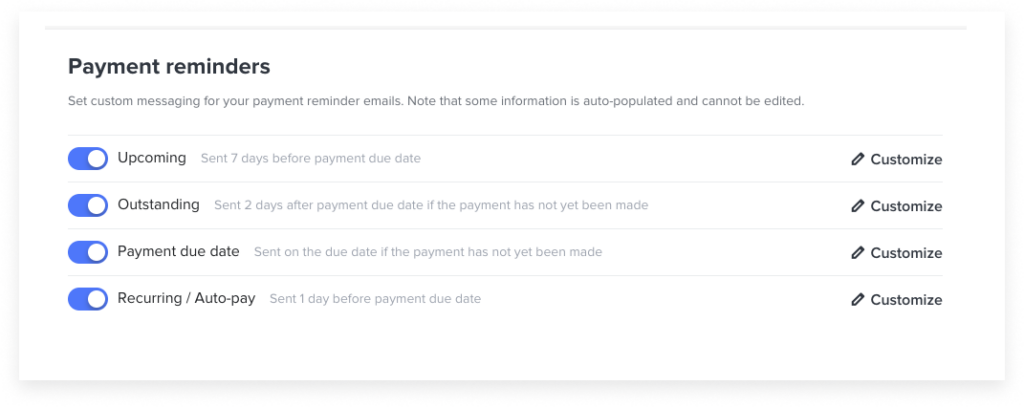

10. Take advantage of automated emails

Keeping track of which payments are late and how late can take up too much of your time. If you’re manually sending reminder emails, it’ll become tedious. Instead, use automated email reminders that you can set up for each client. Just because they’re automated doesn’t mean that they can’t be personalized. When you set up your email templates, you can still incorporate your friendly, natural tone.

With a system like HoneyBook, you easily turn on payment reminders so you don’t even have to think about them. Not only do you increase your chances of getting paid on time, but you can also spend less time writing emails.

3 examples of payment reminder emails

Here are some useful payment reminder email templates that will help you get paid faster.

Payment reminder email in advance

Sending this email a week in advance is a great signal to your client that you expect to be paid on time. For your first payment reminder email, keep it polite, short, and informative.

Here’s how to write a great one-week reminder email:

Copy/paste template:

One-Week Reminder Email

Hi Maria,

I hope you’re doing well! This is a friendly reminder that invoice #1, totaling $1,000, is due for payment on October 1—one week from today.

Please feel free to contact me if you have any questions about the invoice or payment details.

Thank you,

Rick Roberts

In this email, you don’t need to be too aggressive. In this case, we didn’t attach the invoice or include payment details, as we assumed the client has this information and is prepared to pay on time.

Due date payment reminder email

It’s also advisable to send an email on the date the invoice is due. In this case, you still want to keep it friendly, but you should include more payment details.

Here’s an example of a payment reminder email on the payment due date:

Copy/paste template:

Due Date Reminder

Subject: Payment Reminder: Invoice #01 – Due Today

Hi Maria,

Good morning! I just wanted to remind you that invoice #1, totaling $1,000, is due for payment today (October 1).

I’ve attached a copy of the invoice for your convenience. Payment can be made by direct deposit, bank transfer, or check.

Best wishes,

Rick Roberts

Because the client still hasn’t paid by the due date, you want to make it as easy as possible for them to pay you by providing the total balance, how to pay you, and the original invoice. But you can still keep the payment reminder message light and friendly because there’s still the chance that they’ll pay you when you send the email.

Late payment reminder email

Once the client has reached a week without paying you, you have the green light to shift to a firmer tone.

Here’s how to write a late payment reminder email:

Copy/paste template:

One-Week Reminder

Subject: Payment Reminder: Invoice #01 – One Week Overdue

Hi Maria,

I hope all is well. My records indicate that I have yet to receive payment for invoice #1, totaling $1,000. The invoice was due on October 1st, making it a week overdue.

I’ve reattached the invoice for your convenience. Payment can be made by direct deposit, bank transfer, or check.

Best wishes,

Rick Roberts

Once again, this past-due email example gives the client everything they need to know to be able to pay you. Note that it’s worded as “I have yet to receive payment,” neutralizing the issue of the late payment and not placing any blame on your client.

How to send a payment reminder email

You can send your reminder messages manually through any email platform like Gmail. However, you’re missing out if you’re not using some type of invoicing or payment software.

The right software is designed to take work off of your plate. So, it makes it easier to refer to previous invoices and helps you improve client communication through templated emails and automatic reminders.

When should you send payment reminder emails?

The exact number of emails and when you send them will vary based on your business and invoicing schedule, but it’s best to send reminder emails before the payment is due, on the due date, and after the payment due date (if necessary).

Here’s an example payment reminder email cadence:

- Advanced reminder: sent a week or a few days before the due date

- Due date email: sent on the due date

- First late payment reminder: sent a week after the payment due date

- Second late payment reminder: sent two weeks after the payment due date

- Third late payment reminder: sent when the invoice is a month overdue

By keeping a predictable and regular payment reminder cadence, you’ll establish the professionalism and value of your business—showing your client that you take getting paid seriously.

How to avoid late payments in the first place

Knowing how to handle late payments is one thing, but the best strategy is to avoid them in the first place.

I recommend setting up invoice reminders at the start of any project or client relationship. Once again, this is where an invoice software can come in handy, since many of them do this automatically. Without lifting a finger, you can sure your clients are aware of upcoming payments.

It also helps to set up recurring billing when possible. With this method, your clients can add their credit card to your online payment portal and select automatic payments so they’re billed automatically according to the approved payment plan.

Customer retention strategies

Beyond just securing payment, consider discussing strategies for maintaining positive relationships with customers even when sending reminder emails. This could include offering flexible payment options, demonstrating empathy for customers facing financial difficulties, or providing incentives for prompt payment.

What to do if you don’t receive payment

Before you even face outstanding payments, it’s best to establish your payment policies at the outset. This means writing down your terms and procedures and including them in all of your contracts. That way, you’ll know how to proceed in every situation.

It’s best to determine what steps to take when a payment is any number of days overdue as well as how to handle different amounts. For example, if a payment is 30 days overdue and more than $500, you may want to consult a lawyer. At 90 days overdue, it may be time to turn over the invoice payment to a collection agency.

These procedures are only examples, but it’s best to consult with a business lawyer to determine your best plan before taking any legal action.

What can you do if your client doesn’t pay?

You would hope that your respectful, reasonable, and professional email reminders—interspersed with a few firm but compelling voicemails—would prompt your client to respond so that things could be worked out amicably. But hope is neither a strategy nor a solution.

However, if all your communication channels are failing to retrieve your client’s unpaid debt, you may need to take more formal action, beginning with a debt collection letter. A debt collection letter may inform a debtor of their debt, initiate a repayment plan, preview impending legal proceedings, or combine these tasks. If the debtor does not respond promptly with full payment of their debt, you can formally begin the collections process, either by doing it yourself or by hiring a collection agency.

Before engaging an agency, consider this: Collection agencies will keep a substantial fraction of the debt as their payment, which often makes them a poor choice for collecting small debts. Additionally, sending a client’s debt to collections is a predictable way to sever ties with that client. Ask yourself if you’re willing to burn that bridge before you take any action.

Get paid faster with the right tools

Getting paid on time isn’t just about successfully reminding your clients. It’s about setting the right terms in your contracts, offering an easy way to pay, and tracking payments seamlessly. You can do it on your own, or you can save time with a clientflow management platform.

With a system like HoneyBook, you can create the best collateral for selling your services, send online invoices and contracts, and get paid through the click of a button.