Sending invoices is one of the key administrative duties consultants need to master. Learn how to choose from the best invoicing software for consultants to simplify this process and get paid more quickly.

As a consultant, you make your livelihood by leveraging your expertise to help individuals or businesses. Your days are packed with research, meetings, and appointments. Your evenings are spent catching up on client communications, managing your social media strategy, and marketing yourself to new clients. The last thing you have time to do is chase down payments.

This lack of free time may be one reason that 74% of 1099 contractors report getting paid late throughout their careers. Simplifying the billing process with the best invoicing software helps both you and your clients. You save time and energy with invoicing billing software that does most of the administrative work for you, while your clients enjoy updated payment options, billing reminders, and more.

Here’s what you need to know about the best invoicing software for consultants.

Jump to:

- You deserve to get paid: The billing process for consultants

- More is more: What to look for in invoicing software

- Comparing the best invoicing software for consultants: 5 options evaluated

- So what’s the best invoicing software for consultants?

You deserve to get paid: The billing process for consultants

Research shows that more than half of 1099 contractors, including freelance consultants, are owed $50,000 or more on work they’ve already finished.

There are a number of reasons clients might not pay contractors. Some clients are intentionally malicious, banking on the idea that consultants might not have the time or resources to continue following up on missed payments. Some clients are dissatisfied with the work done and believe they shouldn’t have to pay money because of it. But all too often, payments are missed due to simple human errors. Clients forget that they have outstanding bills to pay, or consultants forget to send the bills in the first place.

Consultants can eliminate these issues by fine-tuning the billing process. Instead of sending invoices ad hoc, whenever they remember to send them, consultants with a strong billing process:

- Send estimates to clients before completing their work

- Convert estimates to bills as soon as they’ve completed their work

- Send reminders about outstanding bills on a consistent schedule

While some consultants manage to stick to a consistent billing process on their own, it can be time-consuming to track all stages of payments for all clients. Investing in billing software eliminates the guesswork, reduces the mental load, and simplifies your life.

More is more: What to look for in invoicing software

There are a number of factors to consider when you’re evaluating good invoicing software. You’ll want to consider factors like ease of use, payment tracking, customization options, billing templates, and pricing. But one thing that is rarely explored when it comes to evaluating the best invoicing software is how well the software takes care of other administrative needs.

The best billing software is more than just billing software. When evaluating the right tools to invest in, you should consider all of your administrative needs, not just one or two of them. Instead of looking for a decent piece of software to take care of only your invoicing, consider looking for software that’s capable of handling all of your client communications.

Looking for an all-in-one client communication platform rather than just focusing on invoicing software eliminates the need for multiple platforms. It means you don’t need to juggle multiple systems or make multiple payments. By choosing one piece of robust software, you cut your administrative workload down significantly, freeing yourself up to spend more time on the consulting aspect of your business.

Comparing the best invoicing software for consultants: 5 options evaluated

Invoicing software is designed to help you create and manage invoices and collect online payments. But let’s be honest: If that’s all you want to do, you can manage it with a free PayPal account. Consultants looking to elevate their business and simplify the invoicing process need more, from easy payment tracking to customizable templates.

Let’s take a look at the best invoicing software for consultants, including what each solution gets right as well as which features it may be lacking.

HoneyBook

HoneyBook stands out as an all-in-one client management platform rather than just another invoicing option. It provides an endlessly customizable platform for independent contractors, as well as an easy-to-use home base for the clients they serve.

Payment processing

HoneyBook provides clients with a frictionless online bill-pay experience. Clients can pay their bills with credit cards, debit cards, or ACH bank transfers. They can even set up autopay so their bills always get paid on time without you or the client having to spend extra energy on the process.

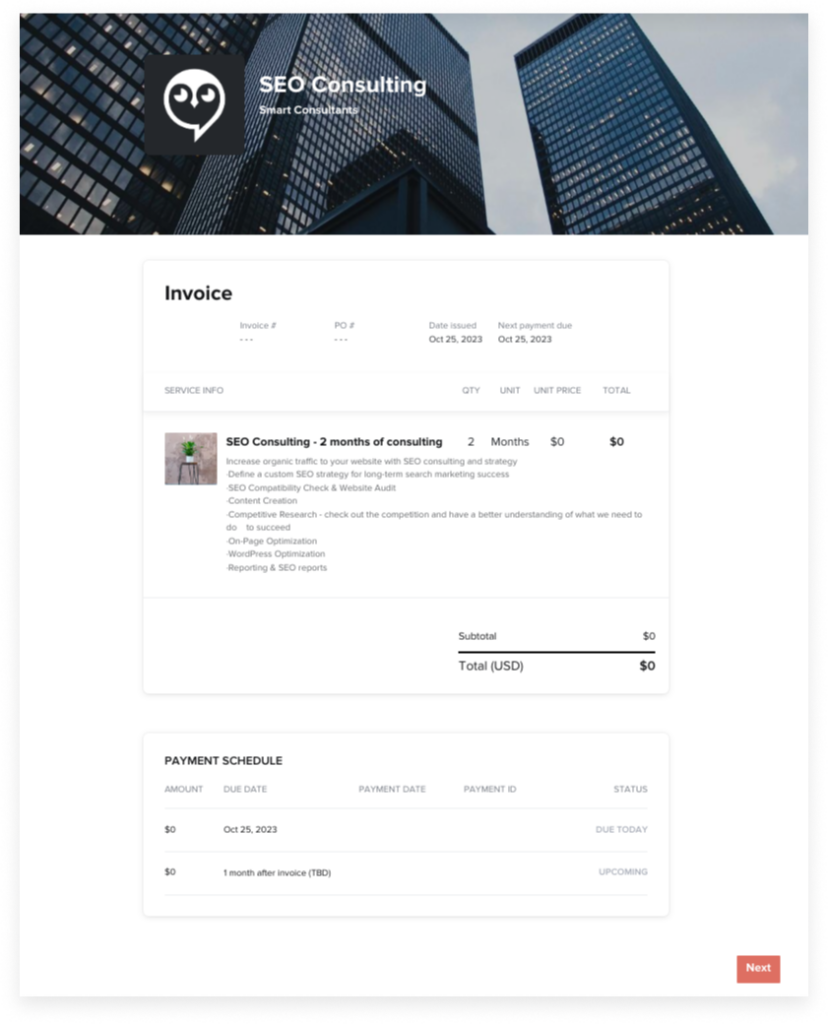

Invoice templates and customization

HoneyBook offers fully customizable online invoice templates. Start with a professional-looking template. An easy user interface allows you to update the template as you like. Give premade templates a facelift with customized color choices, logos, and more, and save your favorite templates to use them again and again.

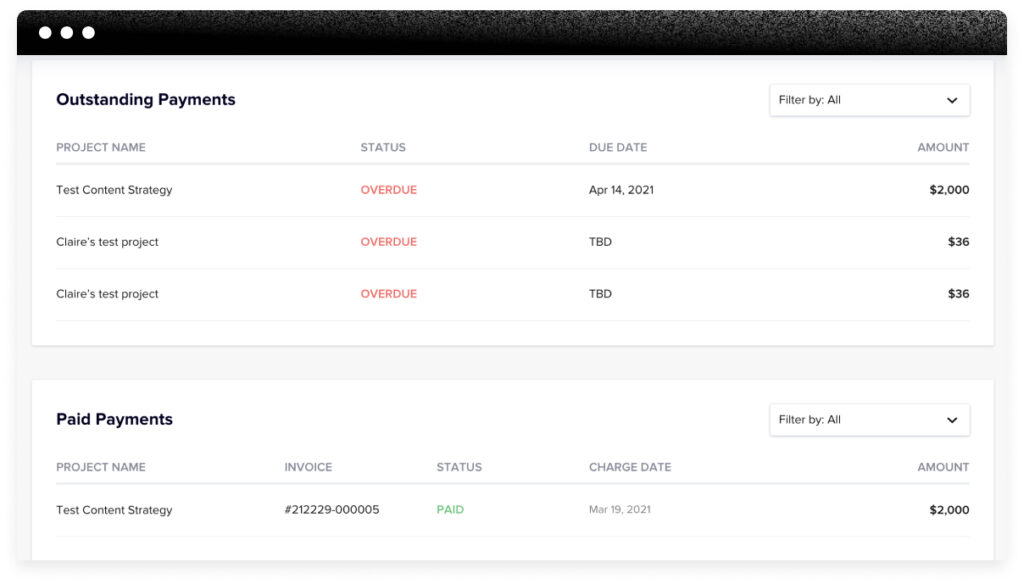

Invoice and payment tracking

HoneyBook allows you to track invoices and payments from your web browser or mobile device. Autopay and recurring payment options make it easy for your clients to pay their invoices on time, and automatic payment reminders ensure unpaid bills never fall through the cracks.

Client portal

HoneyBook provides a convenient client portal, allowing all of your clients to track communications, review files, send messages, and make payments from the same convenient location. By keeping everything on one centrally located platform, you improve the communication between you and your clients, increase your workplace efficiency, and keep your consulting business as professional as possible.

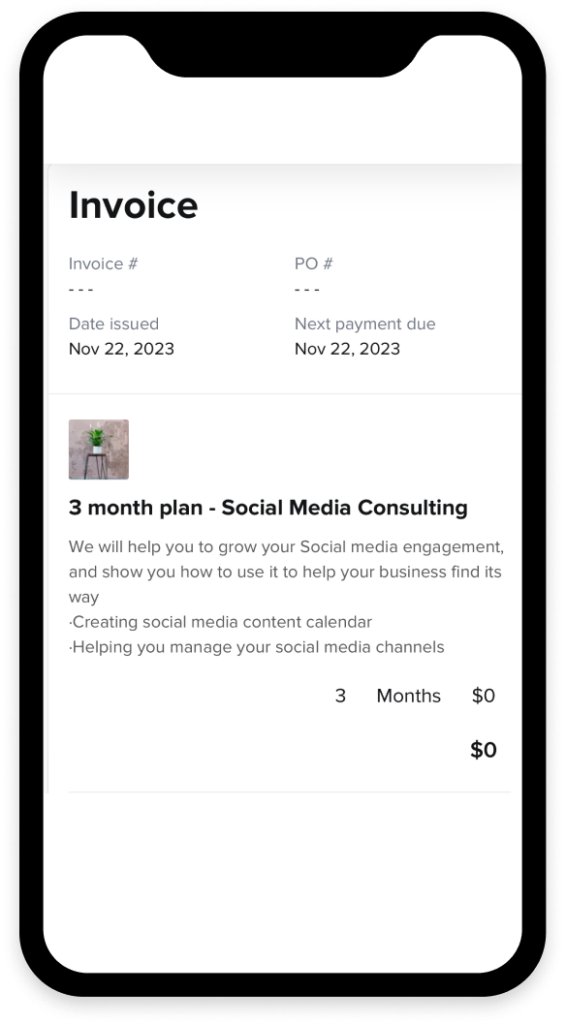

Mobile app

HoneyBook has a mobile app that’s compatible with both iOS and Android devices. Respond to client communications, receive payment notifications, and even create new projects on the go. This mobile-friendly accessibility is critical for consultants who may be traveling, attending meetings, or visiting other clients on a regular basis.

Additional features

HoneyBook is designed to be much more than basic invoicing software. It offers numerous additional features beyond sending invoices and receiving payments. Some of HoneyBook’s standout features include:

- Send proposals contracts to clients and receive secure online e-signatures

- Automate emails, tasks, and more

- Schedule client meetings and send automated meeting reminders

- Manage client communications, projects, and more while integrating with the top tools you’re already using

Zoho Invoice and Zoho Books

Zoho’s solutions, Invoice and Books, are designed to simplify invoicing and bookkeeping.

Payment processing

Although Zoho Invoice doesn’t have its own payment processing system, it integrates with ACH payments and some of the top online payment gateways, including Stripe, PayPal, Square, and more. Most clients will be able to find at least one payment gateway they’re comfortable using.

Invoice templates and customization

Zoho Books has a system in place for customizing invoice templates, purchase orders, receipts, and more. You can customize the fields in your headers and footers, include your own branding, change fonts, and do much more.

The only downside to Zoho’s customization options is that you can’t click on the template and make your adjustments directly. Instead, you adjust the fields outside the template and then view how those changes would impact the look of your invoice.

Invoice and payment tracking

Although you can keep track of customer invoices and payments with Zoho, it’s not the easiest process. To track invoices and payments, you have to generate the invoice history and customer balance reports. This does give you a precise look at each customer’s history with your business, but it makes it difficult to see outstanding payments at a glance.

Client portal

Zoho offers a client portal that allows your customers to see their quotes, invoices, and time sheets in one location. They can view their outstanding balance with your company and easily download their statements. There’s even a collaboration feature that allows clients and consultants to discuss quotes and reach a final agreement without going back and forth via arduous emails.

Mobile app

Zoho Invoice offers a unique mobile app that integrates with Siri, allowing you to set transactional reminders in a hands-free setting. You can also send out invoices, estimates, and account statements and even use a time-tracking widget to keep track of your billable hours with a client.

Additional features

Zoho Books offers a number of standard accounting features, including payment links, payment reminders, and recurring invoices at the lowest payment plan. However, you have to pay a premium price if you want to access premium features like signature integrations and budgeting assistance.

QuickBooks Online

QuickBooks is a popular option designed for small- and midsize-business owners.

Payment processing

QuickBooks allows customers to directly pay their invoices using digital payment methods, including credit or debit cards, ACH payments, Apple Pay, PayPal, and Venmo. Customers can even set up autopay for recurring invoices or bills.

Invoice templates and customization

QuickBooks does allow you to customize your invoices. However, any changes you make to your invoices, including changes to your logo or company information, will change that information across the board within your QuickBooks account. This means you cannot use the same QuickBooks account to run multiple businesses or design unique invoice templates for specific clients. QuickBooks also does not allow you to customize sales receipts.

Invoice and payment tracking

Although QuickBooks tracks payments that you make, allowing you to create 1099 forms easily, it’s much more difficult to track payments your clients make to you. If you want to see if a client has paid a specific invoice, you can open that invoice and see when a payment was made or how many days overdue the payment is. However, you need to integrate a separate invoice tracker into your QuickBooks account if you want to send payment reminders to clients or see at a glance which invoices are overdue.

Client portal

Although QuickBooks offers Customer Account Management Portals (CAMPs) for its users, it’s a far cry from the robust client portals other invoicing software options provide. QuickBooks’ CAMPs allow clients to pay invoices and download receipts, but that’s about it. Clients can’t review past transactions, update contact information, or sign documents within the portal. In fact, the client portal is so lacking that there are companies offering separate client portals to integrate with QuickBooks just to improve this feature.

Mobile app

QuickBooks offers mobile apps that are compatible with iOS and Android devices. These apps are free to use with an existing QuickBooks account and provide on-the-go accounting functionality.

Additional features

Some of the features that make QuickBooks stand out include inventory management, accounting reports, and project profitability reports. For some industries, these accounting features can help track nuanced budgetary information. However, consultants may find that the robust accounting features cannot adequately replace the client management features found with other invoicing software options.

Xero

Xero is cloud-based accounting software that’s based in New Zealand. It’s specifically designed for small-business owners.

Payment processing

Xero allows customers to pay directly from their invoices using a credit card, a debit card, Apple Pay, Google Pay, or an ACH bank transfer.

Invoice templates and customization

Although Xero allows you to customize templates, it’s not the most straightforward process. Xero uses a system called “advanced invoice templates.” Users can download these templates as DocX files, edit them offline, and then upload them back into Xero’s system. Advanced invoice templates can get a bit tricky, because if you edit the wrong fields, they no longer integrate with Xero’s system. However, this system also allows for some truly customized templates.

Invoice and payment tracking

Although Xero doesn’t have its own invoice and payment tracking system, it integrates seamlessly with an app called Invoice Tracker. Using Invoice Tracker, you can automatically sync your invoices and your Xero account. Invoice Tracker updates every few minutes, so reminders can go out frequently, but never after a payment has been received.

Client portal

Xero does offer a customer portal. Clients can use the portal to view invoices, expenses, bills, and bank transactions. They can also reach out to Xero’s customer support directly from the portal if they have any questions.

Mobile app

Xero offers the Xero Accounting App for mobile devices. This app is free to download and is included with a Xero subscription.

Additional features

Xero is largely built as accounting software. Most of its additional features are accounting-related. For example, in addition to sending and receiving invoices, Xero allows you to claim expenses, reconcile your bank accounts, and even perform accurate multi-currency accounting.

Xero also empowers users with financial analytics, asset tracking, and even automatic sales tax calculations so you can stay on top of every aspect of your business’s finances.

FreshBooks

FreshBooks offers web-based accounting software for small- and midsize-business owners.

Payment processing

FreshBooks does not have its own system for receiving payments; instead, you have to integrate your FreshBooks account with a platform like Stripe or PayPal. However, FreshBooks integrates well with these third-party platforms. Your clients can choose to make their payments directly from the invoice, and FreshBooks will automatically track those payments in your account.

Invoice templates and customization

FreshBooks offers two invoice templates: simple and modern. However, you can customize these templates to your liking. You can also save your customized templates to use again and again.

Invoice and payment tracking

FreshBooks allows you to send invoices, set up recurring invoices, and schedule automatic payment reminders. You can also track invoices from the moment you send them out until the moment they’re paid. FreshBooks will show you when customers receive and view your invoices, and you can even set up notifications so you know the moment your clients have paid.

Client portal

Although FreshBooks has client portal software, the portals are limited to a certain number of “primary clients.”

Mobile app

FreshBooks does have a robust mobile app that allows you to send invoices on the go and keep track of your time. However, it’s important to know that the mobile app does not allow you to generate reports on the go; you have to use the desktop version to do that.

Additional features

FreshBooks offers a number of advanced accounting features, including profit-and-loss reports, bank reconciliation tools, automatic expense recording, late payment reminders and fees, file sharing, time tracking, multi-currency accounting, and online e-signature capabilities. These robust features make FreshBooks a top contender for the best online invoicing software. However, FreshBooks stays firmly in the accounting landscape and does not extend to overall client management and communication.

So what’s the best invoicing software for consultants?

While some clients choose not to pay consultants for a variety of reasons, many more clients who don’t pay their bills simply forget that they owe their consultants any money at all. The best invoicing software for consultants meets clients where they’re at while simplifying the invoicing process.

After comparing the five most popular invoicing software options for consultants, HoneyBook is the clear winner. HoneyBook offers a robust suite of features, from customized invoices to convenient client portals, making it easy for consultants to bill clients without spending hours each day tracking down payments.

By offering the greatest blend of cost-effectiveness, critical features, and ease of use, HoneyBook makes choosing the best invoicing software for consultants a no-brainer. Get started with HoneyBook today.