It doesn’t matter what you do as a small business — sooner or later, you’ll find yourself asking “Where’s my money?” This is where billing software for small business comes in.

Payments can be tricky when you’re small, and since you’re obviously not working for free, how can you make sure you get paid when you need it?

Good billing software is a powerful thing. And the best billing software for small business can solve your worst problems effortlessly, almost like it was magic. In fact, when it comes to the money question, the best billing software for small business may be just what you need to get paid smoothly and on time.

That’s what this article is about — helping you find the best billing software for how you charge your customers.

Generally, you’ll want to look for three main capabilities when choosing a billing software:

- A way to charge credit cards (because credit cards are really popular!)

- A way to accept payments online (because the internet is taking over small business!)

- A way to get more done with less time and effort (because who has extra time?!)

Let’s take a closer look at these capabilities, and examine a few other things to keep in mind also when you’re deciding on the best billing software for small business.

How To Charge Your Customers’ Credit Cards

Credit cards are currently the most popular and widespread way to pay for anything, both online and offline. So whether you run a brick-and-mortar store, an eCommerce site, or a service-based business, it’s a good idea to be able to accept credit cards as payment.

It wasn’t too long ago that credit card processing was somewhat of a hassle to deal with. If you were a merchant, typically your only option was to do all the work yourself, which often involved setting up a merchant account, making sure you had a decent payment gateway in place, and negotiating processing fees with your provider.

These days, there are plenty of ways to outsource all those tasks. Most of those ways involve using helpful billing software companies that will do all the legwork for you, behind the scenes. So all you have to worry about is getting customers — the credit card processor will do the rest and make sure the money gets to where it’s supposed to be.

Some Great Tools That Can Help With Credit Card Processing

Running a Brick-And-Mortar Store? Square Makes Life Easier.

When it comes to physical stores, where you need to swipe or scan your customers’ cards in-person, there may not be a billing software system out there that rivals Square.

Square has made quite a name for itself with its top-quality card readers, chip scanners, and iPad POS terminals — all integrated into the seamless software for a delightful payment experience, both on your end and your customers’.

With an entire add-on suite of software tools such as email marketing, employee payroll, and team management, there can be no doubt that Square is a top contender for your brick-and-mortar store that will take a lot of the pain out of credit card processing.

Selling Online With an Ecommerce Platform? Stripe Might Just Be For You.

Stripe is quickly becoming the standard in billing software tools for small businesses operating eCommerce stores online. Often known as a developer-centric tool, Stripe is incredibly versatile and customizable and can be easily integrated into your website or app for a direct and seamless experience.

Stripe’s many integrations with other software tools, such as accounting and invoicing systems, and CRM software, often allow for convenient Stripe account signups from directly within the program, which has, in part, contributed to Stripe’s increasing prominence in the eCommerce sector.

Do You Sell Personal or Freelance Services? HoneyBook Takes the Prize.

There really isn’t any tool quite like HoneyBook for small businesses and freelancers, covering the broad spectrum of functionality and features that it does. In fact, it may be the best billing software for freelancers, period.

HoneyBook’s payment processing is built right on top of Stripe’s secure platform, which leads the industry, so if you were worried about security, you can rest easy. If that weren’t enough, HoneyBook also has its own in-house fraud protection to further ensure your transaction safety.

If you’ve dealt with billing clients previously, you’ll know that sometimes, despite your best efforts, there may still be a falling out with your client about payment. The good news is; if you’re ever in over your head with this, the team at HoneyBook will personally help you handle client disputes, so you won’t always have to just refund your client immediately.

With some online billing software for small business, you’ll get the surprising thrill of finding your transaction fees vary by credit card or billing method. Not so with HoneyBook! You’ll get flat transaction fees across the board — so no surprises, ever!

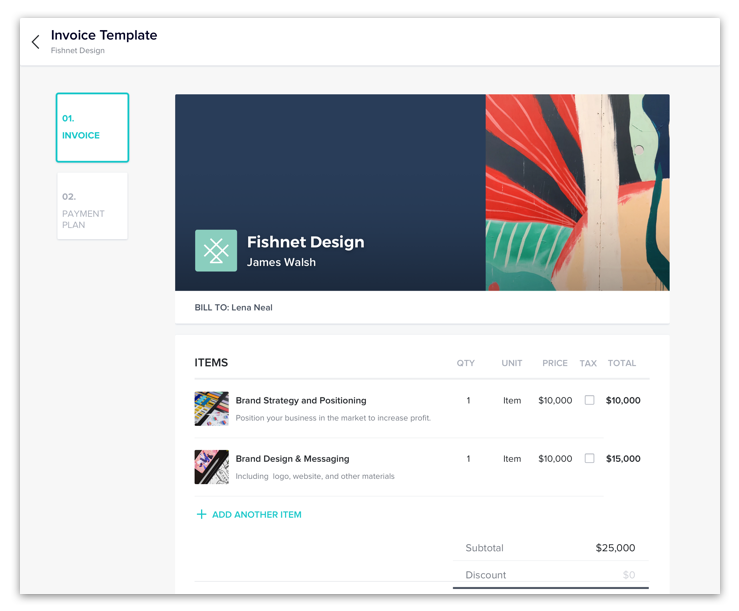

While HoneyBook definitely has full payment processing capacities, what really makes it stand out is its full range of additionally helpful tools, such as invoicing, proposals, contracts, templates, CRM functionality, scheduling, and basically just everything you’d need to run a small business all in one place.

So yes, HoneyBook makes collecting payments a breeze, but it takes it a step further for you and makes running your business a breeze!

HoneyBook is a recommended tool for anyone looking to manage their time better and get more done more efficiently. And it’s extended functionality may just make it the best billing software for freelancers.

Want a Deeper Look?

Check out our article on the Best Payment Processors For Small Business and our breakdown of Credit Card Processing for Small Business.

Accepting Payments Online – What’s Involved

Even if your business is purely brick-and-mortar right now, chances are good there’s some way you can profit by bringing it online, whether it’s through an eCommerce website or even selling on Instagram.

Especially today, when online purchases are rapidly becoming more prevalent, you’re almost guaranteed to need some kind of online billing software for small business eventually, so you can take payments online.

It’s a good idea, at least. But how exactly will that work for you?

What You Need In Order to Accept Online Payments

You’ll need a few things set up in order to start accepting payments online properly. They are:

- A payment gateway (basically a virtual, online card-reader)

- A merchant account (a temporary holding account that allows you to take card payments from your customers)

These two pieces are essential to the online payments puzzle, and if you don’t have them, one way or another, you won’t be able to accept payments. Alternatively, you can use a third-party which organizes the payment gate and merchant account for you. Online billing software for small business can save a lot of hassle and time if you don’t want to mess with this side of the business.

If you’d like more info on payment gateways and merchant accounts, feel free to check out our longer, more detailed article, How To Accept Payments Online.

What’s Going On Behind The Scenes – The Process Behind It

It can be kind of complicated to understand what’s actually happening when you start accepting payments online…Let’s briefly break it down by the steps. There are essentially four of them:

- Your customer submits their payment information, which is transmitted by the payment gateway to the merchant account.

- The payment processor contacts the customer’s card network to check if funds are available.

- The issuing bank approves or denies the request.

- The sale is processed (or not.)

This is an obvious simplification of the process, but you can see the basic steps laid out very clearly. (Once again, if you’d like to read more in-depth about this subject, check out our article on How To Accept Payments Online.) Also, remember that this entire process usually takes less than a second to complete.

There are a few types of software that are particularly helpful when it comes to online billing software for small business…

Some Software Tools That Will Help You Easily Accept Payments Online

Just Need the Basics? PayPal Is A Classic…

You’ve undoubtedly heard the name PayPal before — that’s because it’s the biggest name in payment processing.

PayPal is an established company that’s will provide you with all the basic features you need for your business to start getting paid, especially if you’re just getting started. PayPal does have some variable fees that you’ll need to watch out for. Learn about PayPal’s credit card fees here.

Want to Process Recurring Payments? HoneyBook Can Help With That.

If you have regular invoicing needs for your business, a platform like HoneyBook is probably the way to go. You’ll get the flexibility of different types of payment schedules built-in for you, as well as templates to quickly create your invoice for each client. In addition, HoneyBook offers an iOS app and Android app that allows you to create and send online invoices on-the-go.

Let’s say you’re a freelance copywriter, and you work on a monthly retainer. It can be a real headache having to create an invoice every month, and send it on time, right? With HoneyBook, freelancers simply create an invoice and set up a payment schedule for all payments. This one-time process means you can easily charge your clients on a recurring basis, without having to be hands-on every time a payment is due. Plus, HoneyBook allows your customer to securely opt-in to automatic payments, so they don’t have to remember to pay the bill on time or re-enter payment information.

Not only do recurring payments almost guarantee you’ll get paid on time, but they also reduce stress and hassle for the business and client. Since many freelancers charge monthly, once again, HoneyBook may deserve the top spot for best billing software for freelancers.

Have Something Else You Need?

Check out our in-depth article on How To Accept Payments Online, where we explore more ways to accept payments.

Beyond Payments – Before Choosing Your Billing Software, Ask Yourself…

There doesn’t seem to be any absolute, one-size-fits-all guideline to choose the best billing software for a small business. Every business is unique, and thus your own unique factors will play into your final decision.

Here are some additional questions to consider…

Which Tool Has The Most User-Friendly Interface?

Not all platforms are designed equally. If you’re going to be using your billing software weekly, we highly recommend starting a free trial and getting a feel for the interface.

Are you looking for billing only? Or an all-in-one tool that has billing included?

Many of the softwares we’ve mentioned focus only on payments, whereas HoneyBook is more of an all-in-one tool that provides multiple business functions in one place.

- All-in-one Software (billing included): HoneyBook

- Billing-only software: Stripe, Paypal, QuickBooks (bookkeeping)

Which Tool Provides The Best Payment Tracking Capabilities?

Billing and payment tracking are both critical to getting money in your pocket. Stripe, PayPal, HoneyBook and most billing softwares we’ve mentioned do include some form of payment tracking. Here’s our breakdown of the best payment tracking softwares, based on your needs.

- Best Payment Tracking for Freelancers: HoneyBook

- HoneyBook allows freelancers to manage their client (or project) and payments related to that client (or project) in the same place. Having your payments in context with your client conversations makes this the top choice for freelancers. Additionally, HoneyBook sends automatic payment reminders to your clients when a payment is upcoming or overdue, so you don’t have to chase down payments.

- Best Payment Tracking for one-off invoices: PayPal, Square

- These are good solutions if you’re billing on a one-off or semi-regular basis and don’t mind your communication and client details being in a separate place.

Struggling with tracking all your due payments? Learn more about How to Track Payments and Get Paid as a Freelancer.

More Questions to Consider…

Are you wondering what the best billing software for freelancers is? Or maybe which is the best for setting up recurring payments? Of what the best billing software for small business in general is? We dig into those questions and more in our article Best Payment Processor For Small Business.

Are you a Small Business or Freelancer? Try HoneyBook for Frictionless Client Billing

HoneyBook is an all-in-one small business solution that offers an easy way to bill your customers, in addition to client management, contract, and communication tools.

Looking for an all-in-one solution to client billing? Try Honeybook’s clientflow management platform.

HoneyBook, the best crm for solopreneurs, streamlines everything you need to manage your business into one place. Manage projects, book clients, send an online invoice and get paid through our online payment software. Now peace of mind comes with just one login.